Company

JobGet Inc.

Timeline

Q1 2022 - Now

Increased free > paying customer conversion from 1.4% to 7%.

Starting in Q1 2022, JobGet aimed to explore additional revenue streams by monetizing services for small and medium-sized business (SMB) employers. This became one of the biggest focus in my team starting then.

The MVP solution

JobGet initially chose a pay-for-performance model over a subscription model due to its higher revenue scaling potential. After employers posted a job, they would see an option to set a budget and promote their listing. Employers can choose from one of the following plans:

Daily Budget: Set a maximum spending limit per day. The promotion will end once the daily budget is fulfilled.

Total Budget: Set a maximum overall spending limit. The promotion will end when the total budget is exhausted. This could take a few weeks or just a couple of days, depending on how quickly the budget is spent.

In March 2020 when we initially launched, the conversion rate from free to paid employers was only 1.4%.

"Why would you or would you not pay for hiring tools/services?"

After the initial launch, we started to gather feedback from both paying employers and those who dropped off at the job promotion step.

Through interviews and surveys, we identified a common factor that determines whether employers will pay extra for job postings:

Make a hire(s), fast.

However, the reasons employer won’t choose to pay for a hiring service or tool is clearly presented as well:

Not guaranteed for a good result

As a newer hiring platform, JobGet's limited brand recognition makes employers hesitant to pay for services upfront since they lack confidence in its ability to deliver good results.

Unclear of the pricing model

We saw majority job promoted was on a daily budget (80.8%). Although we implemented tool tips for the “total budget” pricing model, employers mentioned they’re still not sure what it means.

HMW promote clarity and build trust with SMB employers to try JobGet's paid product, so we can helping them make hires faster?

Solution 1: Optimize design for growth

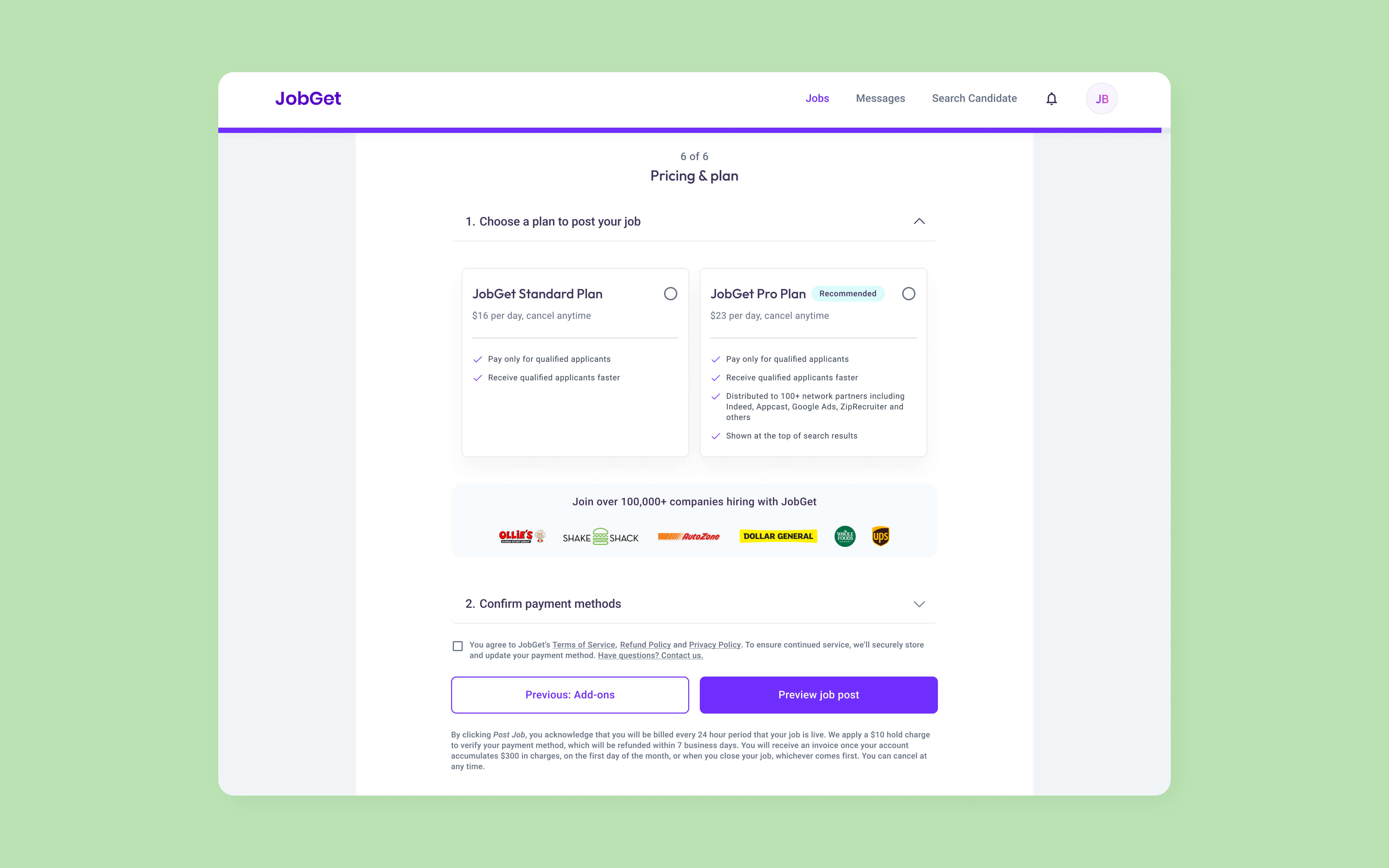

Minimize the steps to improve conversion

The original JobGet PAJ (promote a job) experience required two separate steps. By combining the "pick a plan" and "checkout" steps into one, we can reduce drop-off.

Social proof empowers trust

As a relatively new platform, employers feel reluctant to use JobGet for their hiring needs. Seeing other nationwide brands using JobGet helps build their trust.

Emphasize on the benefits

Explain the benefits in simple & easy language. Highlight “what’s more” comparing to a free plan.

Post your job, and your first promotion on JobGet is on us.

This change in Q2 2022 helped JobGet to growth the conversion from 1.4% to 7% (employers who posted a job to employers who promoted a job).

Different results via qualitative VS quantitative validation

We also experimented 2 different ways of free trial:

🗓️ Time-based free trial: Try for 4 days, pay on the 5th day.

💰 Usage-based free trial: $80 promotion credits were given to employers to use.

Qualitatively, from the usability tests, people found the fixed-time freemium was easy to understand.

Interestingly, from a quantitative perspective, the fixed-amount trial showed a better conversion rate (free trial to promoted job) and generated more profit.

Solution 3: Highlight comparisons

Optimize design for growth

Several design improvements remain on our roadmap: creating clearer plan comparisons; adding decoy options; minimize the checkout process to reduce cognitive load. However, due to competing priorities, these updates remain in the backlog as of Q4 2024.

1.4% to 7%

Conversion from employer who posed a job to paying employers

18x

Monthly revenue from Mar 2022 - Oct 2022

Continuous learnings for growth design

The balancing act between LTV & Conversion

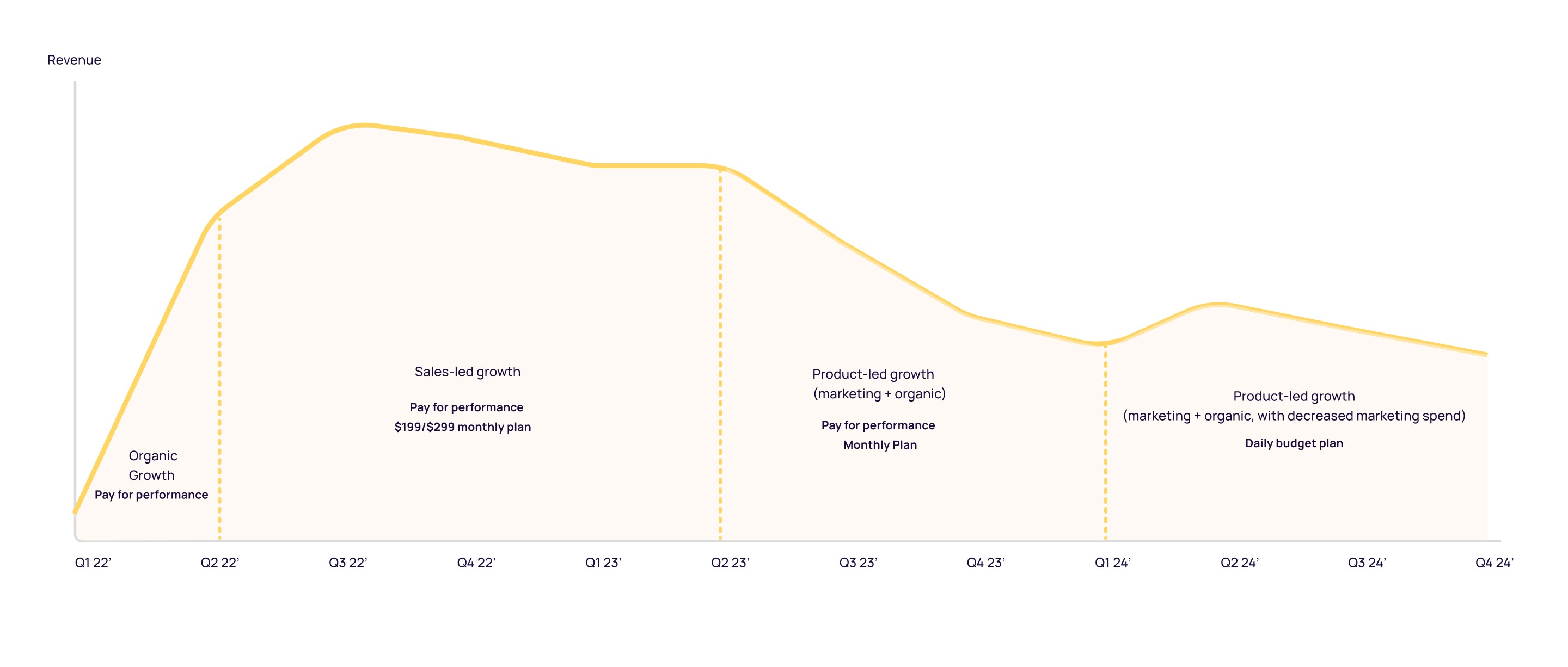

Our business goal for SMB monetization is to increase monthly revenue, which depends on two key factors: conversion rate and LTV (spend per paying customer). In an ever-changing market, adaptability is essential.

When we experimented with monthly subscription plans of $199 or $299, we saw a decline in conversion rates but higher LTV and increased total revenue.

Balance of different variables outside product

From 2022 until now, we have experimented with different pricing models and revenue growth strategies—ranging from sales-led growth to paid marketing to product-led organic growth. All these factors influence our key results, and we continue to learn and adapt as we navigate new challenges each day.